Introduction: Why RCS matters

Rich Communication Services (RCS) is the modern successor to SMS/MMS, first defined in 2008 by the GSMA. It blends SMS reliability with features like high‑res images, typing indicators, read receipts, carousels, and business‑grade interactions (Lifewire). Built around the Universal Profile and supported by Google’s Jibe hub, RCS has expanded rapidly across global carriers, bringing verified messaging and rich content to over 2.5 billion users monthly as of 2024 (Wikipedia).

RCS has become critical not just for personal chat enhancements but especially for business messaging: serving as a more engaging, secure, and high‑ROI channel than traditional SMS. Engagement rates, click‑throughs, and real‑world use‑cases show why brands across retail, banking, telecom, travel and government have embraced it (Master of Code Global).

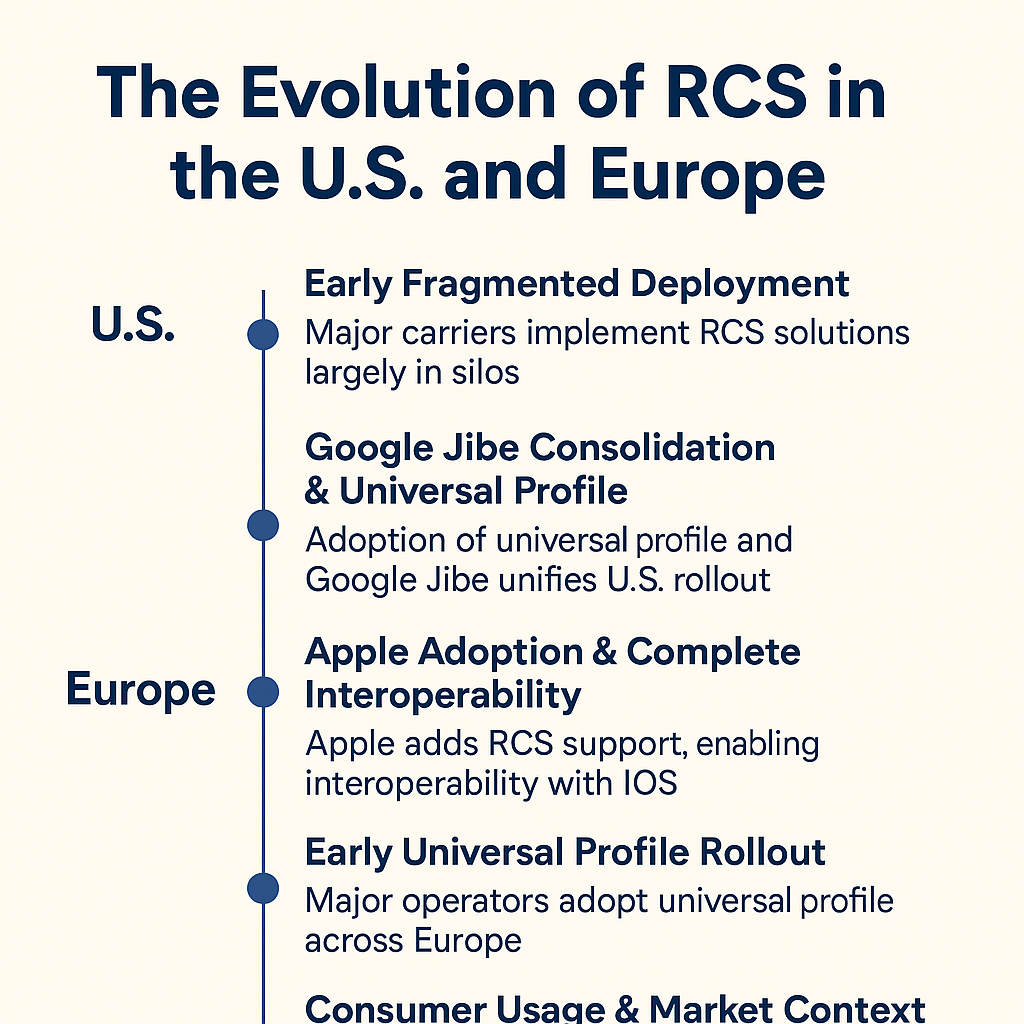

Evolution in the U.S. market

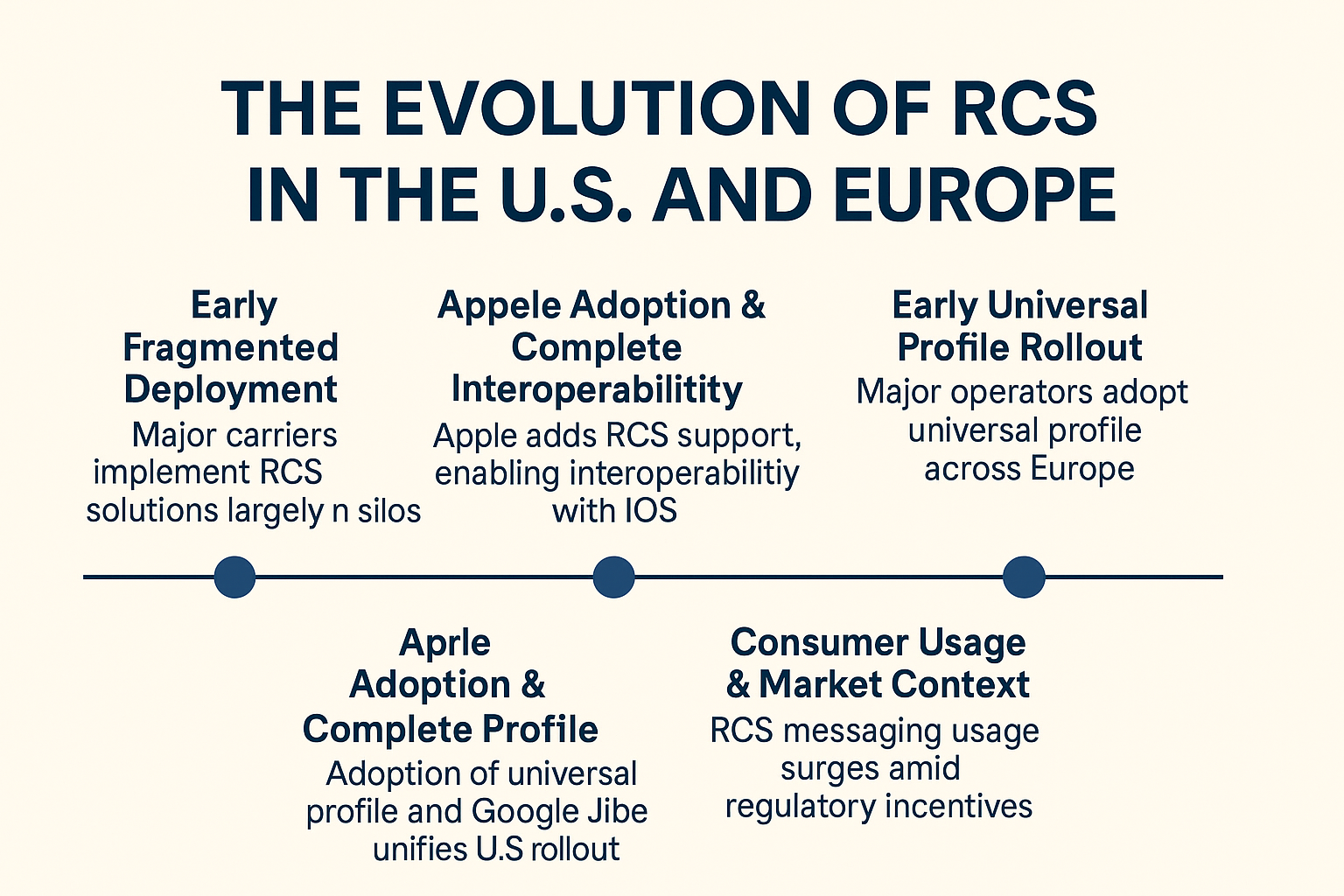

Early fragmented deployment (pre‑2019)

- Although RCS specifications existed from 2008, early rollout in the U.S. was inconsistent, with each major carrier (AT&T, Verizon, T‑Mobile, Sprint) deploying proprietary RCS or “Advanced Messaging” in incompatible siloes (Wikipedia).

- In 2019, all four major carriers announced a joint Cross‑Carrier Messaging Initiative (CCMI), but that effort failed by 2021 after T‑Mobile’s acquisition of Sprint and integration challenges (Wikipedia).

Google Jibe consolidation & universal profile (2021–2024)

- T‑Mobile and AT&T signed partnerships with Google (via its Jibe backend) in 2021–2022 to unify RCS delivery under Google Messages; Verizon followed in early 2024, retiring its proprietary app in favor of Google’s RCS hub integration (Wikipedia).

- With this consolidation, RCS became the default messaging protocol for Android in the U.S., covering nearly all major carriers and ensuring cross‑carrier compatibility and branded experiences (e.g. “Chat”) (Wikipedia).

Apple adoption & complete interoperability (late 2024)

- A pivotal moment came in Fall 2024, when Apple added RCS support in iPhones with iOS 18. This finally brought interoperability between iPhones and Android devices—eliminating issues like green/grey bubbles and low resolution media (The Guardian).

- Although Apple launched without end‑to‑end encryption (E2EE) initially, Google Android-to-Android RCS already supported E2EE. The GSMA adopted RCS Universal Profile v3.0 in early 2025 to formalize interoperable E2EE, followed shortly by v3.1 with improved media quality such as xHE‑AAC audio codec support (Android Central).

Usage & business messaging adoption in the U.S.

- North America generated some 38.5 % of global RCS messaging revenue in 2024. Google reports over 1 billion daily RCS messages in the U.S., reflecting mature consumer uptake (Mordor Intelligence).

- A global RCS study (June 2025) notes that U.S. business use ramped up notably in 2023–2024: early case campaigns—like Subway—saw 140 % higher conversions via RCS vs SMS. Many Fortune‑500 enterprises had adopted RCS by early 2025 (LinkedIn).

- Overall, global business messaging volume rose over 40 % year-over‑year in mid‑2023, and 2024 delivered another 558 % jump in RCS traffic—a 9× increase in two years—with North America growing 14× in that same period (Infobip).

Growth trajectory in Europe

Early universal profile rollout (2017–2019)

- Major European operators—Orange, Deutsche Telekom, Vodafone, Telefónica/O2—embraced Universal Profile RCS early, enabling interoperability across Western Europe by the 2019 timeframe (Wikipedia).

- In markets like Germany and France, operators branded their RCS offerings (e.g. “Chat”, “SMS+”, “joyn”), in some cases leveraging Google’s cloud backend or their own RCS hubs (Wikipedia).

Consumer usage & market context

- Europe grew steadily: for example Orange France saw a 400 % rise in RCS usage in 2023 compared to 2022, underscoring rapid consumer transition to richer messaging functionalities (MessageFlow).

- Regulatory context—particularly GDPR and the EU Digital Markets Act—created incentives to shift business messaging toward operator‑verified channels like RCS rather than unregulated OTT apps, further accelerating adoption across sectors (Mordor Intelligence).

Business use‑cases & campaigns

- Businesses across Europe increasingly use RCS for A2P communications such as airline e‑tickets, government alerts, financial services notifications, appointment scheduling and chatbot interactions, especially in France and Germany (LinkedIn).

- Infobip reported strong results in Europe. For a motorcycle retailer in France, combining RCS, SMS and email in one campaign yielded 72 % open rates, a cost-per-click 14× lower versus MMS, and only one‑third the number of messages needed to achieve the same conversions (Infobip).

- Additional case: Telekom Deutschland ran RCS‑based Spotify trial offers, achieving 26 % higher open rate, 66 % greater engagement, and 120 % uplift in conversion compared to SMS alone (Master of Code Global).

Use‑cases and sector impact

Retail & omnichannel marketing

- BUT (France) integrated RCS into an omnichannel strategy—combining WhatsApp, Instagram, email and RCS—to grow their WhatsApp opt‑in base by 123 %. Their RCS marketing campaigns reached 5 million+ contacts with 20 campaigns; click‑through reached 20 % in one campaign (Sinch).

- Target (U.S.) used RCS across coupon campaigns—enabling product carousels and one‑tap offers—and saw coupon redemption rise 42 % versus SMS-based messaging (Fortis Communications).

- Across multiple brands, campaigns using RCS achieved click‑through rates 3×‑7× higher than rich SMS; 80 % conversion rates; campaigns generated 6× ROI; and users engaged with rich media for up to 45 seconds (Master of Code Global).

Banking & financial services

- BankBazaar (India) saw a 130 % higher click‑through rate in credit‑score and app promotion campaigns via RCS vs SMS (Master of Code Global).

- Axis Bank built self-service RCS chatbots for loans and credit card inquiries, delivering personalized journeys and achieving a 45 % lift in cross‑sales opportunities (Master of Code Global).

Telecom customer service & billing

- Telekom Deutschland transformed billing notifications and upsell messages using RCS branded chat, with rich carousels and action buttons, producing significantly better engagement vs SMS campaigns (Forbes).

- Telecom providers globally use RCS to deliver usage alerts, plan change reminders, outage notices and one‑tap support, all within a secure chat environment where users can respond or take action in‑message (Master of Code Global).

Public safety & government alerts

- In the U.S., Google is enabling text‑to‑911 via RCS in areas where standard SMS support is missing. Emergency responders can receive exact location, images and video from incident scenes. This feature began rolling out in late 2024/early 2025 at no cost to agencies (The Sun).

- European governments and transportation authorities in countries like Italy and France are trialing RCS for transit alerts and travel reminders, offering branded, interactive updates (LinkedIn).

Key statistics & trends

| Metric / Region | Statistic |

|---|---|

| RCS monthly active users (global, 2024) | ~2.5 billion users (Wikipedia) |

| North America revenue share (2024) | 38.5 % of total RCS business market revenue (Mordor Intelligence) |

| RCS message growth (global, 2023) | Up 358 % vs prior year (Infobip, MessageFlow) |

| RCS growth (global, 2024) | +550 % (i.e. 9× in two years); North America alone grew 14× (Infobip) |

| Orange France usage growth (2023) | +400 % year‑over‑year (MessageFlow, technologyforyou.org) |

| Business messaging ROI | Up to 6.2× return; 80 % conversion; click rate 3–7× higher than SMS (Master of Code Global, linkmobility.com) |

| Campaign benchmarks | 72 % open rate, cost‑per‑click 14× lower, ⅓ volume for same conversions (Infobip, Sinch) |

| Fortune 500 businesses using RCS (2025) | ~65 % vs ~28 % in early 2023 (Fortis Communications) |

Why U.S. and Europe diverged—and now converging

U.S.: device-led, carrier consolidation

- The U.S. went through a long, fragmented phase until Google unified Android RCS under Jibe and carriers adopted it. Apple’s delay until iOS 18 slowed cross-platform interoperability until late 2024.

- Now that both iPhones and Android fully support Universal Profile RCS (even if E2EE rollout lags slightly on iOS), email‑like features—typing, reacting, high‑res media—are consistent across platforms.

Europe: regulation and operator momentum

- European carriers embraced RCS earlier, largely independently of Apple, using Universal Profile as early as 2017. EU regulations (e.g. GDPR and Digital Markets Act) pushed for verified, interoperable channels and built comfort in RCS for public & business use.

- OTT dominance (like WhatsApp) initially limited peer‑to‑peer traction, but business messaging use by banks, airlines, transport and governments became widespread thanks to GDPR-friendly infrastructure.

Convergence: unified rich messaging across markets by 2025

- By 2025, both regions share a common Universal Profile stack, with Google Jibe at the center on Android and native support in iPhones. Encryption (v3.0 spec) became standard, and media quality improvements (v3.1) applied globally (Wikipedia, Android Central, LinkedIn).

- Business brand messaging strategies now follow similar playbooks: interactive RCS campaigns for promotions, chatbots, cross‑sell, service communication. Engagement and ROI metrics are consistent universally.

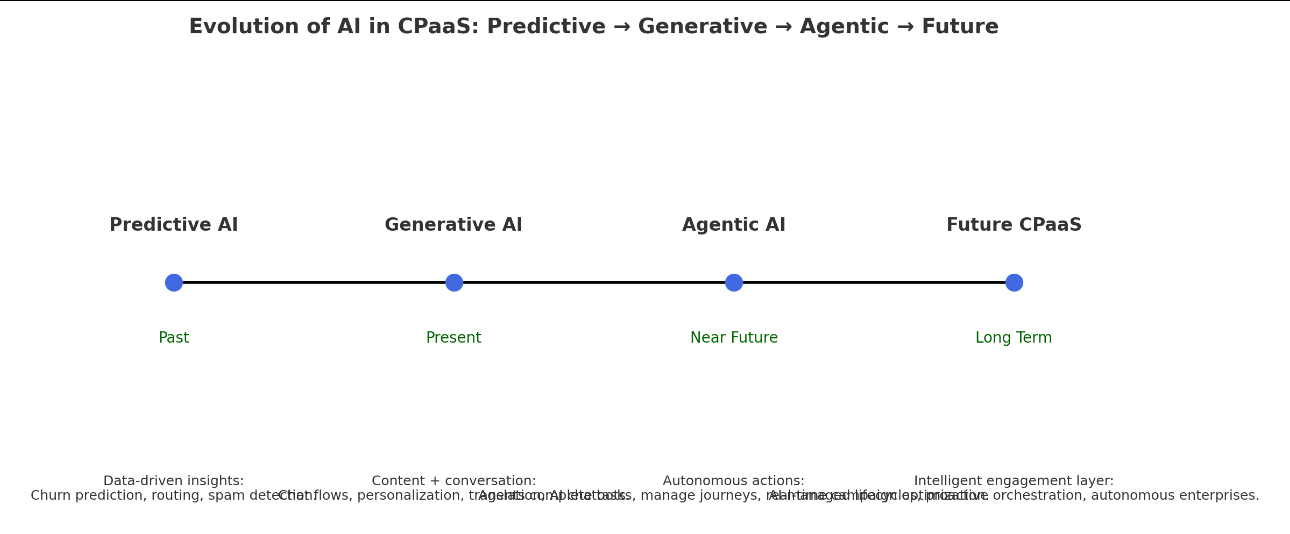

What lies ahead (2025–2028)

Security & advanced profiles

- The GSMA v3.0 and v3.1 profiles (from early and mid‑2025) bring interoperable end‑to‑end encryption and improved media codecs (e.g. xHE‑AAC) for voice notes and richer media (Android Central).

- Verified sender identity and anti‑spam verification will deepen trust levels for brands and governments.

Payments, analytics & conversational commerce

- RCS is poised to support payment flows (e‑commerce checkout, ticketing, appointments) directly within chat threads.

- Analytic dashboards for RCS campaigns are allowing brands to finely measure engagement steps, drop‑offs, and conversion paths in real time.

Regulatory & competitive positioning

- In Europe, the Digital Markets Act may require further OTT interoperability, where RCS could act as middleware between WhatsApp, iMessage, and other platforms.

- In the U.S., 911‑RCS emergency messaging deployments will expand across municipalities, further normalizing the standard for critical communication (WIRED).

Forecast scale

- Juniper and other analysts expect global business messaging volumes to exceed 2 billion users by 2028. With Apple iPhones now integrated, reach will likely crest the 3 billion‑device threshold by 2026–2027 (Forbes).

- Enterprise penetration among top brands is likely to exceed 80 % in developed markets, with engagement metrics outpacing other digital channels.

Great — here’s an additional section (approx. 800–900 words) to extend the blog post with RCS integration guidelines for key industries, including Real Estate, Hospitality, Travel, and BFSI (Banking, Financial Services & Insurance).

You can place this right after the “Use-cases and sector impact” section in the main blog post above.

RCS Integration Guidelines for Key Industries

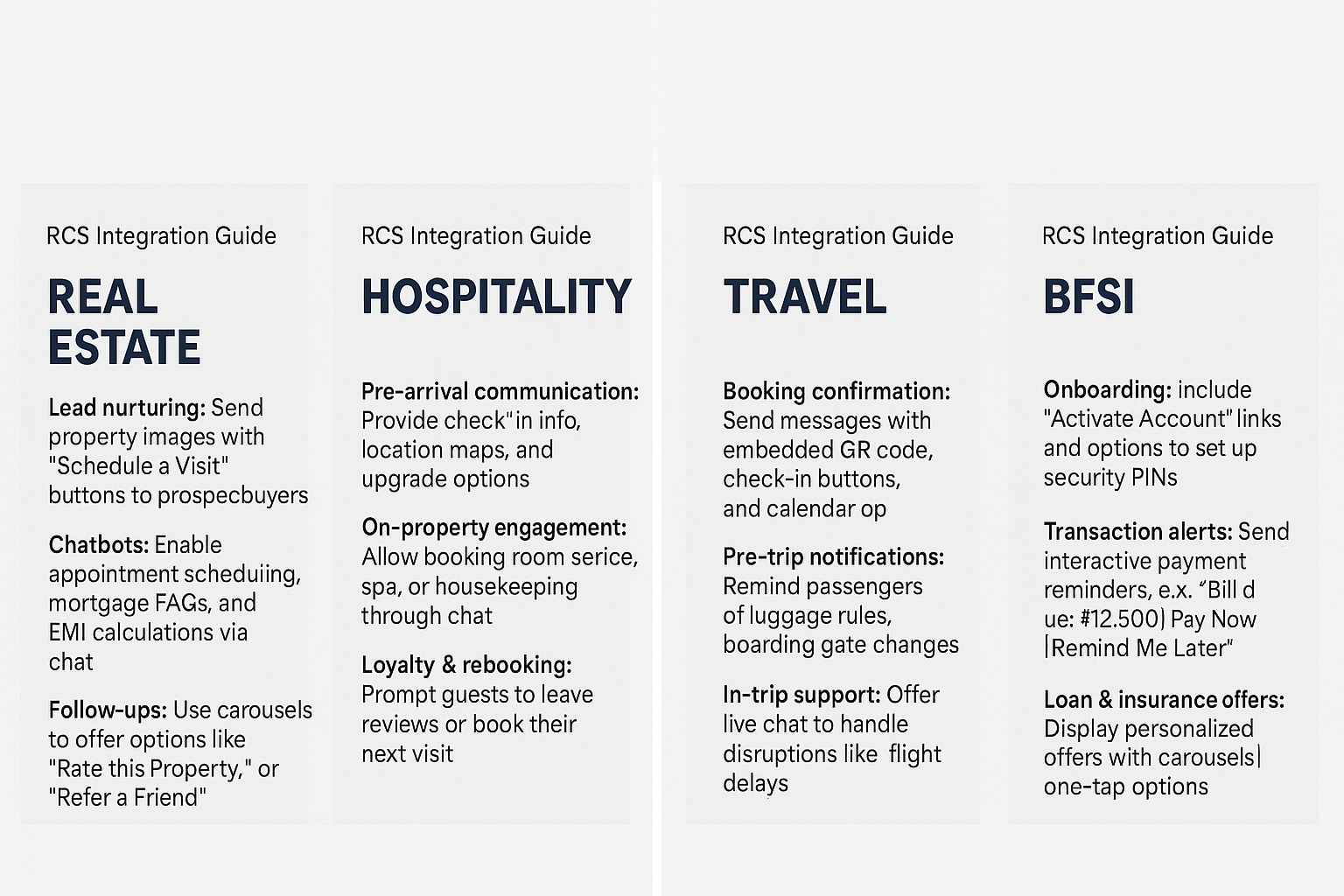

1. Real Estate

Challenges: Long sales cycles, low engagement via SMS/email, lead qualification delays, lack of visual communication.

Why RCS fits:

- Supports high-resolution images, 360° videos, and carousels of properties.

- Enables quick replies for virtual tour booking, EMI calculators, and lead qualification bots.

- Verified sender ID builds trust in a market where fraud is common.

How to integrate:

- Lead nurturing: Send RCS campaigns to prospective buyers with images and “Schedule a Visit” buttons. Add interactive filters for budget, location, or BHK type.

- Chatbots: Use RCS bots for property inquiries, appointment scheduling, mortgage FAQs, and EMI calculations — all in chat.

- Follow-ups: After a property viewing, send RCS messages with carousel options like “Rate this Property,” “Book Again,” or “Refer a Friend.”

Tools: Integrate with your CRM (like Salesforce, Zoho CRM, or HubSpot) using a CPaaS provider like Twilio, Infobip, or Gupshup that supports RCS APIs. Google’s Business Messages or Sinch can also offer seamless onboarding for RCS bots.

2. Hospitality (Hotels & Restaurants)

Challenges: Booking friction, low guest engagement post-booking, upsell fatigue, and poor loyalty loop.

Why RCS fits:

- Dynamic messages: Booking confirmation with maps, check-in links, Wi-Fi password, upgrade offers.

- Rich UI: Use carousels for room types, spa packages, or menu options.

- Two-way interactivity: Let guests modify bookings or check out via chat.

How to integrate:

- Pre-arrival communication: Send RCS with check-in info, upgrade options, location map, and live concierge access.

- On-property engagement: Allow guests to order room service, book a spa, or request housekeeping via RCS chat.

- Loyalty & rebooking: After checkout, send a rich message thanking the guest, prompting for review, and offering discounts for the next visit.

Example: A luxury chain like Marriott or Taj could offer an RCS concierge that allows in-chat room upgrades, real-time queries, and restaurant bookings.

Integration stack:

- Link RCS into your PMS (Property Management System) and CRM.

- Use webhooks or API triggers for automated messages upon booking, check-in, or feedback.

3. Travel (Airlines, OTAs, Railways, etc.)

Challenges: Last-minute changes, ticket delivery issues, customer support overload.

Why RCS fits:

- Interactive itinerary with real-time updates, embedded boarding passes, and live chat.

- One-tap check-in, seat selection, and baggage tracking.

- Two-way updates during disruption (flight reschedules, gate changes, etc.).

How to integrate:

- Booking confirmation: Send RCS with embedded QR code, check-in button, and “Add to Calendar.”

- Pre-trip notifications: Remind users of luggage rules, boarding gate changes, or travel insurance offers.

- In-trip support: Offer live chat within the RCS thread to manage disruptions (e.g., flight delays or cancellations).

- Loyalty: Let users check miles or upgrade eligibility via interactive buttons.

Tech stack:

- Sync RCS API with the airline’s core PSS (Passenger Service System) like Amadeus or Sabre.

- Use Jibe Hub or a CPaaS connector to trigger messages from your booking system.

Example: Lufthansa, JetBlue, and British Airways have tested RCS boarding notifications and achieved higher passenger engagement.

4. BFSI (Banking, Financial Services & Insurance)

Challenges: Compliance-heavy communication, static messages, fraud concerns, low mobile app adoption.

Why RCS fits:

- Verified sender identity, encrypted messaging (with GSMA v3.0), and rich interactivity make it safe and engaging.

- Reduces app dependency — allow transactions or updates right inside the native messaging app.

How to integrate:

- Onboarding: Send RCS welcome kit with “Activate Account,” “Set UPI PIN,” and “Know Your RM” options.

- Transaction alerts: Replace SMS with interactive RCS alerts — e.g., “Bill due: ₹12,500. Pay Now | Remind Me Later.”

- Loan & credit card offers: Provide one-tap lead generation with carousels showing personalized offers.

- Insurance: Use RCS to send policy documents, claim steps, premium reminders, and chatbot for FAQs.

Security note: Though Android-to-Android RCS supports end-to-end encryption (E2EE), RCS for business (A2P) relies on server-side encryption. Always use GSMA-compliant CPaaS providers and deploy sender verification (brand logo, name, and check mark).

Integration tips:

- Tie RCS into core banking systems like Finacle, TCS BaNCS, or Temenos via secured middleware.

- Use APIs from approved providers like Gupshup, Sinch, Infobip, or Twilio. Google’s Business Messages SDK can also offer bank-grade integrations.

Integration Checklist (Cross-industry)

| Requirement | Notes |

|---|---|

| RCS A2P provider | Choose Google-approved partners (Twilio, Sinch, Gupshup, etc.) |

| Verified Sender Profile | Required for branded chats; apply via GSMA or Google registration |

| Backend systems connection | CRM, ERP, PMS, Banking core via APIs or webhook triggers |

| Content templates | Design carousels, quick replies, rich cards in line with brand tone |

| Opt-in compliance | Ensure consent before sending RCS; follow GDPR, TCPA, or RBI norms |

| Testing and fallback | Include SMS fallback for unsupported devices or offline users |

Conclusion: Why businesses and consumers care

- For consumers, RCS means seamless rich chat across devices—high‑res photos, read receipts, group chat reactions, typing indicators—all without needing third‑party apps.

- For businesses, RCS offers dramatically higher engagement and conversion than SMS or email. Brands can deliver branded, interactive experiences inside the native messaging app, driving measurable returns—in many cases 6× ROI or more.

- In the U.S., widespread carrier alignment and Apple support marked a recent tipping point; in Europe, early operator adoption and regulation made RCS a natural next step for enterprise messaging.

- As encryption, media quality, and commerce support deepen in 2025–26, and global reach crosses 3 billion devices, RCS looks set to become the new default standard for customer messaging worldwide.

Key takeaways

- Timeline matters: Europe moved early (2017–2019) under Universal Profile; the U.S. solidified carrier interoperability via Google Jibe and iOS 18 support only in 2024.

- Business metrics speak volumes: Engagement rates 35–80% higher than SMS, conversion of 60–80%, ROI up to 6× or more.

- Use‑cases span sectors: Retail (carousels, coupons), banking (payments & alerts), telecom (billing chat), public safety (text‑to‑911), government alerts.

- Technical evolution: E2EE via GSMA v3.0 in 2025, media/audio enhancements v3.1 mid‑2025.

- Scaling fast: North America 14× volume growth 2022–2024; Europe growing rapidly too; global business messaging revenue projected to reach billions by 2029.

Select area deep dives

United States

- 2021–2024 was the era of consolidation: T‑Mobile, AT&T, and Verizon all adopted Google’s Jibe hub and rolled out RCS branded messaging (“Chat”) across Android phones (Lifewire, MessageFlow).

- iOS 18 launch in September 2024 enabled full RCS interoperability, improving media quality and group chat features between iPhones and Android devices—closing a major cross‑platform gap (The Guardian, WIRED).

- Business uptake surged, with big brands and enterprises launching RCS campaigns. Subway’s campaign saw conversion jumps of ~140% versus SMS; other Fortune 500s adopted RCS steadily (LinkedIn).

- Public safety modernization: Text‑to‑911 via RCS started rolling out in late 2024–2025, supporting multimedia messaging in emergencies, improving location delivery and responder interaction (The Sun).

Europe

- Early Universal Profile adoption by carriers like Orange (France), DT and Vodafone (Germany), Telefónica (UK, Spain), enabling consistent cross‑network support by 2019 (Global Growth Insights, Wikipedia).

- Rapid growth: Orange France saw +400% usage in 2023; Europe business messaging campaigns generated 35% higher response rates vs SMS (MessageFlow).

- Well‑documented business campaigns: Infobip’s France motorcycle retailer case (72% opens, low CPC), Telekom Deutschland’s RCS‑powered Spotify upsell (120% conversion lift) (Infobip).

- Regulatory tailwinds: GDPR trust and EU mandates make RCS a preferred channel for verified and interoperable communication.

In summary, the U.S. and Europe have traveled distinct paths to arrive at the same modern messaging crossroads. Early operator-driven expansion in Europe dovetailed with regulatory momentum, while the U.S. arrived later via carrier consolidation and Apple’s long‑awaited support in 2024. Today, both markets operate on the same Universal Profile stack with encryption and rich media—businesses and governments are leveraging RCS to replace SMS with richer, more engaging, measurable customer experiences.

Views: 19